Ok it It has now been a month since my last posting since I was busy doing some academic work on the side. Anyhow what an interesting time we have had since the 12th of February…Putin venturing into Crimea, China releasing weak numbers, copper collapsing etc….Anyhow it seems that the markets have taken cue to this and that equity markets have retraced. The index map charts below shows the level of significance (T-stats) of the moves observed for major stock indices over various time period. It has been tough over the last week and the main driver was probably the referendum in Crimea due the 16th of March…..

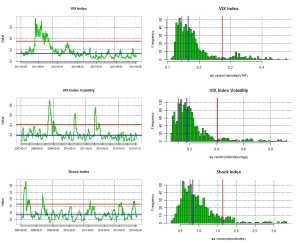

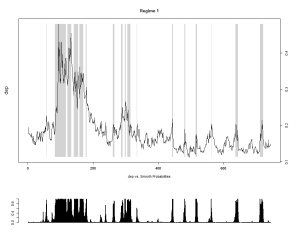

Interestingly enough despite those retracements the VIX has barely moved and my 2 states Markov regime switching model remains entrenched in a more rosy picture of the world.

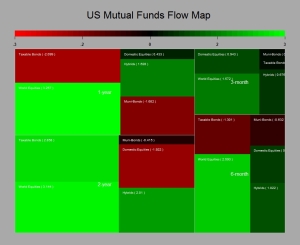

So it is time again to see what inflows/outflows we have had in US mutual funds by looking at the Investment Company Institute data and here below are the usual chart showing the significance of those flows over various time horizon as well as the cumul since 2008. Not much change in what has been seen over the last two years….Buy global equities and sell bonds…

Over the last month close to USD 50bn went into equities whilst USD 19bn came out of Bond products. I ll stay with the crowd…R.I.P PIMCO…..