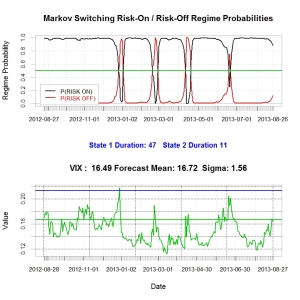

Ok I could not help the reference to Trading Places, it has been 30 years since the movie came out after all but this time it is not about commodities it is all about equities ! Let’s face equities are on fire and there is so much bond holdings to get rid off ahead of central banks taking their liquidity back that. That fuel is not about to run off….after all the move that we have seen in treasury is not that big….or at least there is still some ground for further retracement surely (Fig 1)…event when Bernanke tries to give us some re-insurance about the pace at will they will withdraw liquidity the direction is clear…the bond Pandora box is now officially open !

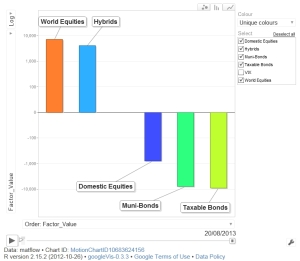

Meanwhile as investor the Fed gives us little choice…. Commodities ? well we have seen some retracement but if the view remain for a muted growth it may not be necessarily the best tactical bet. Bonds ? you skipped a paragraph surely…. Equities seems to be the only way unless you like cash with a very low yield…or want to go for less tangible assets. Clearly the markets have moved that way if you take a look at Fig. 2. Ok Asia and Latam did not do too well but Nikkei 67% and other countries performance says it all …..

Fig. 1: one year performance of major stock indices.

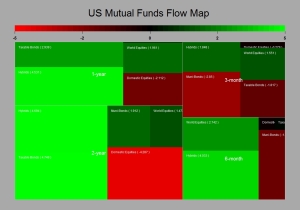

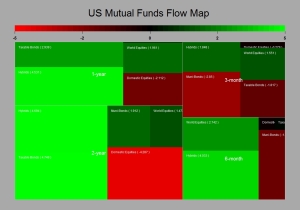

More interestingly as per the very last data from the ICI it seems that there are no abating for bond dislike and equity appetite ! I put out a set of my usual charts for your perusal….

Fig 2: Mapping of Inflow/Outflow in US mutual funds

As I put the question to a well know chief economist a few months ago: Do you think money can create money ? Think a minute…after all it is surely what the Fed must be thinking ? if somehow all that private money shift from bonds to equities those companies will have to use their new stock valuation to do something…look for new market, go into M&A mode, invest in research and development…hire a few peoples and kick start the economy ? This is what I would expect from the CEOs that manages the companies I am invested in or else give me my money back !….Now the question is: If all or greater part of this private money is shifting from bonds to equities what will be the effect on the dollar ? Clearly the current contention is that the significant retracement in bond markets will conduct an upshift in the US yield curve and that this will be beneficiary to the dollar strength….Most economists seem to have been lured by this scenario….I have to say that I am unsure about all this…The US Mutual fund is about US$ 19 trillions in size of which most of it is currently invested in US bonds (either US or global hedged) and it seems from the above that there is a justified and significant appetite for international equities who are generally invested into on an un-hedged basis…bearing this in mind and possibly companies drawing on their rising valuations to support M&A , R&D which are likely to be foreign by nature I would think that this can significantly offset the rising US yield effect and that we could see the US$ depreciating….My feel is that we are seeing a structural asset allocation shift and that old tenets will not hold whilst we are experiencing the renaissance of a true Equity bull market…. a bit like in the 80’…..Looking good Billy Ray !