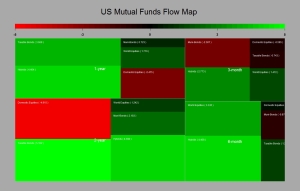

The answer seems to be yes as far as what took place in June. This is the start of a proper bond bear market, thank you Mr Bernanke. When one looks at the June data on outflow / inflow in US mutual funds just released by the ICI it becomes obvious that we are not dealing anymore with ordinary moves. The outflow in taxable bond funds was similar in term of intensity to what we observed in equity funds in October 2008. There is a smell of panic amongst bond investors and with good reason, the remaining inventory is massive and the gate is narrow. The guys at PIMCO would know about it as they had an estimated US$ 10bn outflows last month. What is quite exciting about all this is that we have seen some inflow in international equities over the same period. This clearly looks like the onset of the shift in asset allocation I have been so fond of over the last year and half (see my previous posts). Anyhow I thought I would display my usual charts….please look away if you are still overweight bonds…

The above charts shows the monthly inflow outflow in US mutual funds. The chart on the left plot the data relative to its long term median and 95% up/ interval of confidences. The data for bond is way out of scale. The chart on the left shows the T-stats of the inflow/outflow (i.e. how significant they have been) over various time period. Despite the recent inventory adjustments bond holdings still remain very rich which would indicate that there is further room for a significant sell off in fixed income unless the Fed shy away from its view on tapering, better watch this job data then…..

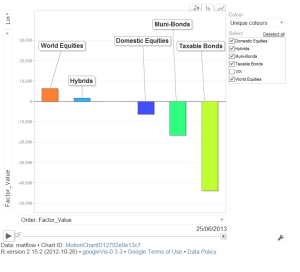

The charts above shows the outflow/inflow relative to the VIX. We have not seen much increase volatility in the equity markets, the VIX averaged 17% in June. We just had a minor outflows in US equities but also interestingly a notable inflow in both hybrids and international equities….This looks like the onset of an asset allocation shift to me. Finally it may be worth to start mulling over what would be the effect of further significant investing in foreign assets by US investors on the strength of the US$…..