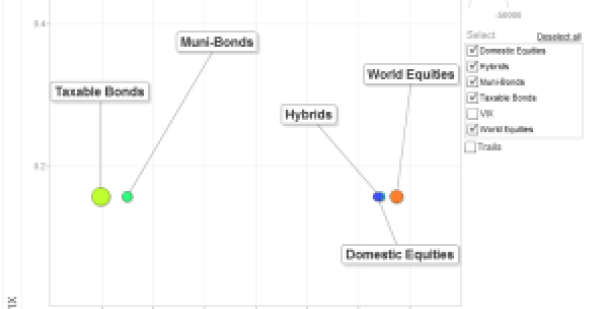

Looks like there is no abating to for equity appetite out there. And there some are good reasons to be hungry for it…bonds won’t g bring you any decent yield whilst still bearing a massive Fed tapering tail risk. Despite the Fed floating some reinsuring words about the measured pace at which they will withdraw the liquidity it supplied, make no mistake they will. Now the big question is: Will the market front run them and dictate the monetary policy going ahead ? Clearly if the bond market inventory is to adjust drastically as your typical US and foreign household start to take more risks in equity markets and redeem their bond funds in the process this must also mean something for the short end of the yield curve……In that respect I am still pondering about the possible effects of this as clearly the outstanding bond holding in US mutual funds is very large indeed not to use the word humongous. Maybe we are not too far to discover what is the answer to this question as there seem to be clearly a general dislike for bonds and a growing appetite for equities out there. The ICI on inflow/outflow in US mutual funds illustrates well what is taking place. The chart below shows what has been the inflow / outflow for the first half of July, significant inflow in domestic and foreign equities and outflows in bond products….Pretty much a continuation of what happened in June, aside the inflows in domestic equities which were negative last month.

Meanwhile if we look at the risk environment, the VIX trades pretty much on its long term median and a 2-state Markov regime switching model tells us that we are fairly well entrenched in a “Risk on” scenario.

Bearing in mind a background of fundamentals that do not seem to be on the awful side if we are to believe Moody who changed its outlook from negative to stable for the US, I can’t help to be still in love with equities….Bond managers, tin hat on please !